If you want to expand your customer base while still turning a profit, then you'll need to focus on customer acquisition cost (CAC). In this post, we give you a quick and comprehensive rundown of how to calculate CAC and which industry benchmarks to compare your CAC against.

But, before we get started, here's a table of contents to help you find exactly what you're looking for.![→ Download Now: Customer Service Metrics Calculator [Free Tool]](https://no-cache.hubspot.com/cta/default/53/e24dc302-9dc2-466f-a5ca-ab4e08633c0f.png)

Table of Contents

- What is Customer Acquisition Cost?

- How to Calculate Customer Acquisition Cost

- CAC Formula

- LTV to CAC Comparison

- Customer Costs by Industry

- Customer Acquisition Cost Examples

What does CAC stand for?

CAC stands for customer acquisition cost. A company's CAC is the total sales and marketing cost required to earn a new customer over a specific time period.

The total sales and marketing cost includes all program and marketing spend, salaries, commissions, bonuses, and overhead associated with attracting new leads and converting them into customers.

Successful companies are aiming to constantly reduce the cost of customer acquisition — not just to recoup revenue, but because it's a sign of the health of your sales, marketing, and customer service programs.

.png)

Free Customer Acquisition Cost Calculator

Calculate your business's key metrics and KPIs for customer support, service, and success with this free template.

- Customer Acquisition Cost

- Customer Lifetime Value

- Customer Satisfaction Score

- And More!

What is Customer Acquisition Cost (CAC)?

CAC, or customer acquisition cost, is a business metric that determines how much it'll cost your organization to attract new customers.

A company's CAC is the total sales and marketing cost that go into earning a new customer over a specific period. This is an important metric to consider when determining the profitability of your company because it compares the amount of money you spend on attracting customers against the number of customers you actually gained. When CAC is compared against LTV (lifetime value), you'll have an even better sense of how profitable you'll be in the future after the customers have been around for a longer period of time.

Customer Acquisition Cost Use Case Scenarios

It can be challenging to pinpoint every budget line item that contributes to CAC, so we've outlined some scenarios that can help you think about where you're incurring costs to acquire customers throughout the business—not just in the marketing swag and gift card departments.

Customer Acquisition Cost in Marketing

If your inbound marketing program is operating successfully, you don't have to dedicate as many resources to paid advertising to generate both high and low-quality leads when your blog content is bringing in high-quality organic leads 24 hours a day.

Customer Acquisition Cost in Sales

Say your sales team is constantly prospecting and nurturing a healthy pipeline. While it might seem tempting to increase headcount, you don't need to rush to hire additional reps to hit your quota each quarter. The reason is because the existing sales reps have enough capacity to handle the number of leads in the pipeline and close those deals.

Customer Acquisition Cost in Customer Success

The customer success team at your company should be retaining and cultivating relationships with happy customers. As a result, they will help the business generate new customers by writing testimonials and reviews, serving as case studies, and telling their friends and family about you. In addition, if the leads from these sources become customers, you will have earned them free of charge, which will lower your customer acquisition cost even further.

When you reduce CAC, that means your business is spending money more efficiently and you'll likely see higher returns. Here's how to calculate your current CAC so you can reduce it.

How to Calculate Customer Acquisition Cost

Step 1: Choose the time period for calculating.

The first step in calculating your customer acquisition cost is to determine the time period that you're evaluating for (month, quarter, year). This will help you narrow down the scope of your data.

Step 2: Calculate your CAC.

Next, add together your total marketing and sales expenses and divide that total by the number of new customers acquired during the period. The result value should be your company's estimated cost of acquiring a new customer.

Below is the formula that you can use to calculate CAC for your business.

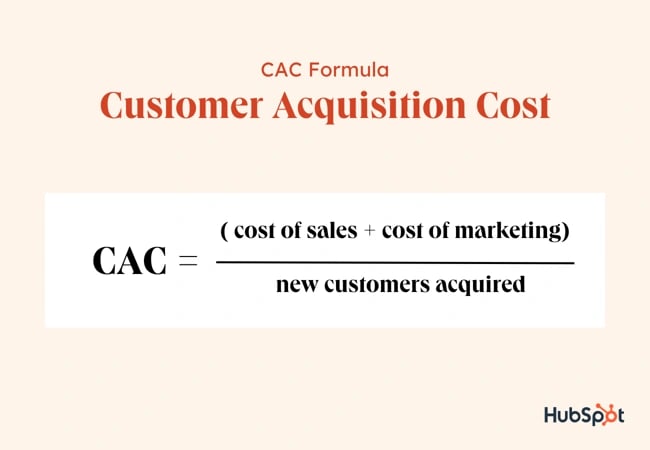

CAC Formula

You can calculate customer acquisition cost by using this formula: Customer Acquisition Cost = Cost of Sales and Marketing divided by the Number of New Customers Acquired.

We can see how this formula plays out in the graphic below.

For example, let's say your company spends $500K on sales and $300K on marketing. Additionally, your company generated 800 new customers during the last fiscal quarter. Therefore, if we were to calculate the CAC for your business, the cost to acquire a customer for that quarter would be $1K ((500K + 300K)/800= 1K).

Step 3: Compare your CAC to key business metrics.

Once you have calculated CAC for your company, you can compare this value against other key business metrics. By doing so, you'll uncover meaningful insights about your marketing, sales, and customer service campaigns.

Featured Resource: Free Customer Acquisition Cost Calculator

Types of Costs to Include in a CAC Formula

If you're unsure of what your "cost of sales and marketing" is, consider the following expenses for this metric.

Ad Spend

Ad spend is the money you're spending on advertisements. For some businesses, advertising is a great way to attract new customers. For ads to work, your campaigns must resonate with your target audience. If you're not sure whether you're getting a good return on a marketing campaign, you can calculate its value by dividing the revenue that's produced by advertisement by the amount of money you spent on that campaign.

Employee Salaries

Great employees are always worth the investment. So, pay close attention to how you approach this cost if you feel it's too high. There may be alternative options for reducing money spent on salaries other than issuing pay cuts or layoffs. For example, chatbots and marketing automation can supplement your team's workflow and improve your company's overall productivity.

Creative Costs

Creative costs are what you spend on creating content. This could be money spent on acquiring talent to promote your company, or it could be what you spent on lunch for your team meeting. All of these costs factor into content production.

Technical Costs

Technical costs refer to the technology that your marketing and sales team use. For example, if you purchased a reporting tool that tracks the progress of your open deals, that would be a technical cost.

Publishing Costs

Publishing costs are what's spent to release your marketing campaign to the public. This could be money spent on TV air time, paid social media ads, or a spot in a newspaper or magazine.

Production Costs

Production costs are the costs associated with physically creating content. For example, if you're making a video, you need to buy a camera, create a set, edit the video, etc. These costs add up, especially if you're paying a third party to produce your content.

Inventory Upkeep

Even if you're a SaaS business, you'll have to spend money on maintaining and optimizing your products. For businesses that sell physical products, this cost would include utility bills and storage fees at a facility. But if you're selling software, this is the money you’d spend on updates and patches to improve the user experience.

.png)

Free Customer Service Metrics Calculator

Calculate your business's key metrics and KPIs for customer support, service, and success with this free template.

- Customer Acquisition Cost

- Customer Lifetime Value

- Customer Satisfaction Score

- And More!

Customer Acquisition Cost Examples

Let’s look at a few examples that illustrate how to calculate CAC.

Example 1: A Software Company

Let’s assume a CRM software company spends $30,000 on a marketing campaign. After the campaign, the company discovered that 2,000 new customers started a subscription for their service.

Every year, the company is expected to spend an extra $50,000 on technical and production costs for these new customers.

The CAC for this software company would be:

CAC = ($50,000 + $30,000) ÷ 2,000 = $80,000 ÷ 2,000 = $40

This means the software company spent $40 to acquire each new customer.

Example 2: A Consumer Goods Company

Suppose a consumer goods company spends $5,000 on sales and $1,000 on marketing to attract 1000 new customers. Then the company’s CAC is calculated as:

CAC = ($5,000 + $1,000) ÷ 1,000 = $6,000 ÷ 1,000 = $6

Example 3: A Manufacturing Company

If a manufacturing company that sells building materials spends $10,000 on marketing and $5,000 on sales but acquires 200 new customers, then the company’s CAC is:

CAC = ($10,000 + $5,000) ÷ 200 = $15,000 ÷ 200 = $75

Example 4: A Real Estate Company

A real estate company that sells duplexes spends $25,000 on marketing and $10,000 on sales. After running their ads, the company acquired 70 new customers.

The CAC for this real estate company would be:

CAC = ($25,000 + $10,000) ÷ 70 = $35,000 ÷ 70 = $500

LTV to CAC Comparison

One metric to analyze in relation to customer acquisition cost is a customer's lifetime value (LTV). LTV is the predicted revenue that one customer will generate throughout their relationship with a company.

To calculate LTV, you'll need a few variables to plug into the formula:

Average purchase value: Calculate this number by dividing your company's total revenue in a time period (usually one year) by the number of purchases over the course of that same period.

Average purchase frequency: Calculate this number by dividing the number of purchases over the course of the time period by the number of unique customers who made purchases during that time period.

Customer value: Calculate this number by multiplying the average purchase value by the average purchase frequency.

Average customer lifespan: Calculate this number by averaging out the number of years a customer continues purchasing from your company.

Then, calculate LTV by multiplying the customer value by the average customer lifespan. This will give you an estimate of how much revenue you can reasonably expect an average customer to generate for your company over the course of their relationship with you.

Thus, your company's LTV to CAC ratio, or LTV: CAC, is a quick indicator of a customer's value relative to how much it costs to earn them.

LTV to CAC Ratio

Businesses use LTV to CAC ratio (LTV: CAC) to guide spending habits for marketing, sales, and customer service. LTV: CAC shows a brief snapshot of how much customers are worth compared to how much the business is spending to attain them.

Companies should aim to find the right balance for this ratio to ensure they're getting the most out of their financial investments. Ideally, it should take roughly one year to recoup the cost of customer acquisition, and your LTV: CAC should be 3:1 — in other words, the value of your customers should be three times the cost of acquiring them.

If it's closer to 1:1, that means you're spending just as much money on attaining customers as they're spending on your products. If it's higher than 3:1, like 5:1, for example, that means you're not spending enough on sales and marketing and could be missing out on opportunities to attract new leads.

At this point, you may be wondering what a good CAC looks like? Well, that may vary depending on your industry. So, to give your team a better idea of what to strive for, the following section of this article breaks down the average customer acquisition costs for different industries.

.png)

Free Customer Service Metrics Calculator

Calculate your business's key metrics and KPIs for customer support, service, and success with this free template.

- Customer Acquisition Cost

- Customer Lifetime Value

- Customer Satisfaction Score

- And More!

Customer Costs by Industry

Customer acquisition cost varies across industries due to several different factors — including, but not limited, to:

- Length of sales cycle

- Purchase value

- Purchase frequency

- Customer lifespan

- Company maturity

So to put CAC into context, here's a rundown of average customer acquisition cost by industry as reported by First Page Sage:

How to Improve Customer Acquisition Cost

There are a few different ways to improve customer acquisition cost to bring that LTV: CAC ratio closer to 3:1. Here are a few strategies to work towards:

- Invest in conversion rate optimization (CRO): Make sure it's simple and straightforward for visitors to convert into leads or for leads to convert into customers and make purchases on your site. Optimize your site for mobile form submissions and shopping, test website copy to make sure it's as clear as possible, and try to create a touchless sales process so your visitors can buy from you 24/7.

- Add value: Increase customer value by giving customers what’s valuable to them. Collect customer feedback, and whether it's a product fix, a new feature, or a complementary product offering, do your best to give customers what they're asking for to make them stick around longer.

- Implement a customer referral program: If your customer refers you to a warm lead from their network who is already interested in learning about your product or service, their particular CAC will be $0 if they convert. These "free" customers will lower your CAC over time, so build a customer referral program your customers want to participate in.

- Streamline your sales cycle: Decrease the length of a typical sales cycle to increase the number of sales you can influence over the course of a year. Use a CRM and prospecting tools to connect with more qualified leads more effectively.

Wrapping Up

It’s only when you know how much it costs to bring in new customers, that you can make informed business decisions and predict how profitable your company would be in the long run.

So, take the time out now, to find your company’s customer acquisition costs to see how you can allocate your resources better.

Editor's note: This post was originally published in October 2017 and has been updated for comprehensiveness.

Image Source

Image Source

-1.png)

![How to Build a Strong Customer Referral Program in 2023 [Ideas & Examples]](https://blog.hubspot.com/hubfs/customer-referral-program_20.webp)

![How to Ask for a Referral From a Client [+ Best Email Templates]](https://blog.hubspot.com/hubfs/referral-FI.jpg)